|

Water Damage Insurance can be tricky and can happen at any time. There are great chances that water damage will happen to you during your homeowner’s lifetime. Water damage insurance claims are among the most common types of property claims and the primary source of frustration.

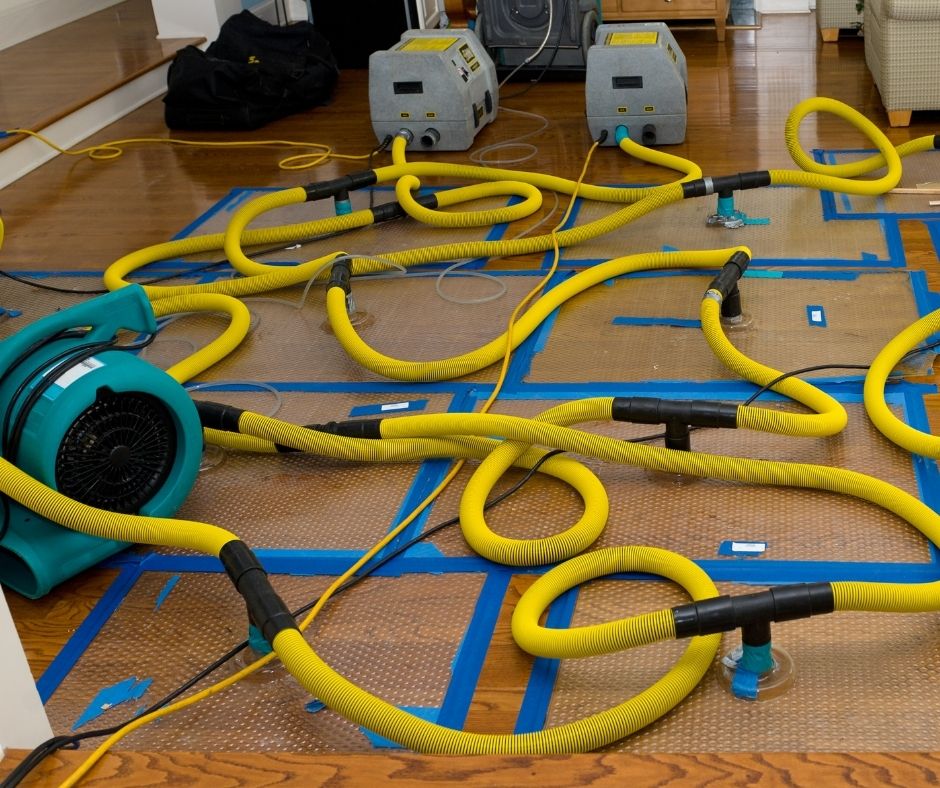

Hence, if you speak to your insurance representative based on what is visible to you at the moment of the call, you may have inadvertently created hardship for yourself. So, if water damage happens to your home or business, there are a few things to know. Water Damage Insurance 1:1Check your insurance policy. In a nutshell, there are many different water damage insurance coverages, and they all vary. Before calling your insurance to log a water damage insurance claim, always ask for a certified copy of your insurance contract. Ask your insurance inside sales representative or agent to include all provisions, exclusions, and conditions. An insurance policy is a complex document with sometimes conflicting and confusing provisions for homeowners that are not used to reading and interpreting them. As an insurance policy uses a specific language, there is no shame in asking for a specialist’s second opinion. In some cases, public adjusters can help you clarify obscure sections of your insurance policy. Even if most insurances cover for accidental or sudden damage, like in the case of a burst pipe in a basement, a toilet overflow, or sewer backup, other forms of water damage appear progressively and cause other issues to your building structure. In the case of mold, for instance. Mold can develop progressively following water damage that was not identified or if the remediation was not appropriately handled. Typically, most homeowners would call their insurance and file an insurance claim for water damage to cover the remediation work. Of course, most people expect their insurance to cover this type of water damage fully. In reality, most of these claims are denied or do not cover all costs involved in the repairs because of a different interpretation of the insurance policy. To avoid coming to that dead-end, there are a few things you can do. What To Do Before Getting Your Water Damage Insurance Claim Denied.Here is what you should consider when preparing or dealing with your water damage insurance claim:

Key Takeaways

22 Comments

7/5/2021 05:08:55 am

Very interesting and thanks for sharing such a good blog. Your article is so convincing that I never stop myself from saying something about it. You’re doing a great job. Keep it up.

Reply

8/16/2021 07:46:18 am

Thanks for sharing such great information. It is really helpful to me. I always search to read the quality content and finally I found your post. Keep it up, keep posting!

Reply

8/17/2021 04:32:27 am

Such an amazing blog, I love reading all your blogs. They are super amazing and informative at the same time. Bookmark your page already, keep posting more

Reply

1/30/2022 07:30:37 pm

Thank you for reminding us that following a flood, it is important that we get in touch with our insurance agent or company to ask about our claims and benefits. The other day my sister's house was hit with a massive flood due to a thunder storm. I will remind her to get in touch with a professional to start the paperworks pronto.

Reply

2/9/2022 10:19:59 am

Most homeowners would call their insurance and file an insurance claim for water damage to cover the remediation work. Thank you for making this such an awesome post!

Reply

3/21/2022 09:47:17 am

A pipe burst in my basement and ended up getting things wet. It makes sense that I would want to get a professional to help me out with this. That seems like a good way to ensure that I don't have to worry about mold or anything.

Reply

4/15/2022 02:55:02 pm

Mold can develop progressively following water damage that was not identified or if the remediation was not appropriately handled. I’m so thankful for your helpful post!

Reply

4/16/2022 08:46:58 am

Poland & Sullivan Insurance Agency works on a personalized experience that learns about what’s important to you and connects you with solutions and financial professionals to help you achieve your goals. Here are the Poland & Sullivan Insurance Agency phone number, Poland & Sullivan Insurance Agency Contact Details so that you can communicate with their team via phone, video, or in person.

Reply

The Stapleton Insurance Group is an American multinational Group whose subsidiaries provide insurance. They provide a full range of #insurance and #financial Group products, #including auto, #business, #homeowners, #farm, and #life insurance throughout the world.

Reply

5/31/2022 02:50:42 pm

Water damage insurance does not cover damage resulting from the homeowners' negligence or failure to maintain the home in good repair.

Reply

6/20/2022 01:43:11 am

Markel Corporation Insurance Company is an American multinational Company whose subsidiaries provide insurance. They provide a full range of insurance and financial Company products, including auto, business, homeowners, farm, and life insurance throughout the world.

Reply

7/21/2022 04:06:07 pm

An insurance policy is a complex document with sometimes conflicting and confusing provisions for homeowners that are not used to reading and interpreting them. Really great article thank you so much!

Reply

7/24/2022 05:51:11 pm

Having a restoration company assist me with proper documentation of a water disaster could be a great way to get compensated for the costs. This way, I will be sure that they have pictures and examples to show whatever insurance company I end up working with in the future to allow myself a better chance of paying off the damage. I'll definitely keep an eye out for any flood damage experts that can lend us a hand with something like this should we encounter it.

Reply

10/6/2022 06:37:47 pm

Thanks so much for the advice on how to work with insurance companies to get help restoring your home. My cousin's house recently flooded and they don't know what to do next. Filing a claim will help them speed up the restoration process and have money to hire some professional rebuilders.

Reply

This is why water damage clean up is so important! Sometimes floods are bigger than expected and can overtop levees or floodwalls. If a river floods for a long time water can damage a levee. Aging dams can be overwhelmed, releasing water with deadly force. Even using the latest techniques and design, structures can and do fail, and the consequences can be devastating.

Reply

11/22/2022 09:47:11 pm

Thank you for noting that you should always request a certified copy of your insurance contract before contacting your insurance to file a water damage insurance claim. Flooding has damaged my grandmother's home. I'll advise her to get in touch with her insurance provider and a water damage restoration business to handle my grandmother's house damage.

Reply

12/6/2022 04:53:12 am

It got me when you discussed that it is hard to fully determine the extent of water damage. My friend told me that their basement was affected by the flooding. I should advise him to hire an expert in residential water damage repair to ensure reliable work.

Reply

7/23/2023 03:47:12 am

Excellent article, We appreciate you providing us with this wonderful blog article. I will be using this tips for my own clients so that there dean mitchell group go smoothly.

Reply

8/5/2023 04:14:31 am

Fantastic article on water damage restoration! It covers all the essential steps and tips for dealing with such a challenging situation. The author's expertise shines through, making it a valuable resource for anyone facing water damage issues.

Reply

9/15/2023 05:48:48 pm

Most water damage insurance policies do not cover gradual water damage that occurs over time. Thank you, amazing post!

Reply

Leave a Reply. |

AuthorMike McCullough is the owner of County Action Restoration Archives

March 2021

|

RSS Feed

RSS Feed