|

Water Damage Insurance can be tricky and can happen at any time. There are great chances that water damage will happen to you during your homeowner’s lifetime. Water damage insurance claims are among the most common types of property claims and the primary source of frustration.

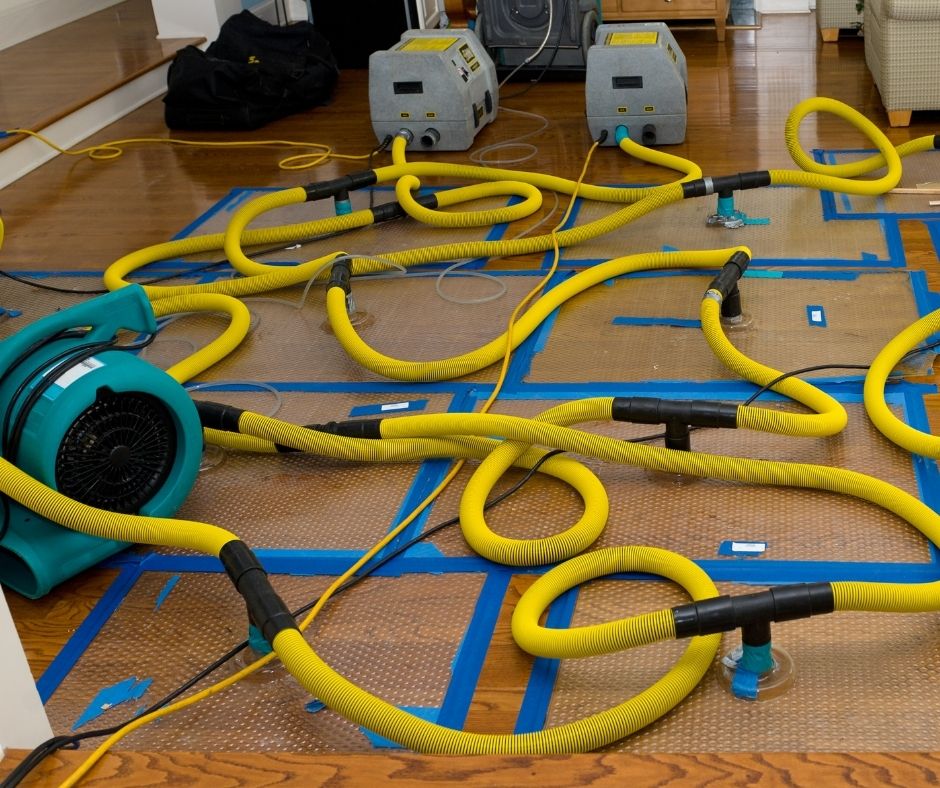

Hence, if you speak to your insurance representative based on what is visible to you at the moment of the call, you may have inadvertently created hardship for yourself. So, if water damage happens to your home or business, there are a few things to know. Water Damage Insurance 1:1Check your insurance policy. In a nutshell, there are many different water damage insurance coverages, and they all vary. Before calling your insurance to log a water damage insurance claim, always ask for a certified copy of your insurance contract. Ask your insurance inside sales representative or agent to include all provisions, exclusions, and conditions. An insurance policy is a complex document with sometimes conflicting and confusing provisions for homeowners that are not used to reading and interpreting them. As an insurance policy uses a specific language, there is no shame in asking for a specialist’s second opinion. In some cases, public adjusters can help you clarify obscure sections of your insurance policy. Even if most insurances cover for accidental or sudden damage, like in the case of a burst pipe in a basement, a toilet overflow, or sewer backup, other forms of water damage appear progressively and cause other issues to your building structure. In the case of mold, for instance. Mold can develop progressively following water damage that was not identified or if the remediation was not appropriately handled. Typically, most homeowners would call their insurance and file an insurance claim for water damage to cover the remediation work. Of course, most people expect their insurance to cover this type of water damage fully. In reality, most of these claims are denied or do not cover all costs involved in the repairs because of a different interpretation of the insurance policy. To avoid coming to that dead-end, there are a few things you can do. What To Do Before Getting Your Water Damage Insurance Claim Denied.Here is what you should consider when preparing or dealing with your water damage insurance claim:

Key Takeaways

22 Comments

|

AuthorMike McCullough is the owner of County Action Restoration Archives

March 2021

|

RSS Feed

RSS Feed